Module 02

02.01 Comparing Different Types of Risk

Video: Understanding Investment Risk

- Risk: the uncertainty that our realized return will not be the same as our expected return

- The level of risk increases, so does the potential reward.

- The more risk you're willing to take, the more you could gain and the more you could lose.

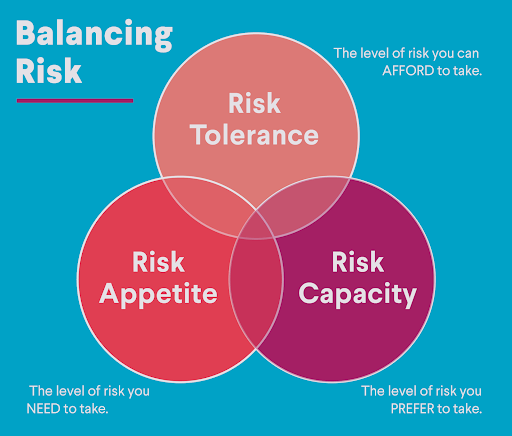

- Risk appetite: an investor's level of comfort taking risk

- Tied to you

- Risk tolerance: how much risk that investor can take on a particular investment based on their goal and time horizon

- Tied to your individual investments

- How much risk is appropriate will depend on the combination of your risk appetite and risk tolerance.

Video: Systematic Investment Risk

- 2 broad categories of risks: systematic risk and unsystematic risk

- Systematic risk:

- non-diversifiable risk

- inescapable or unavoidable

- inherent in the stock market

- present regardless of your choice of investments

- different types of systematic risks:

- purchasing power risk: loss of purchasing power through inflation

- reinvestment risk: the risk that proceeds from an investment may have to be reinvested at a lower rate than what you had already been earning

- interest rate risk: the risk that a change in interest rate will cause the market value of a security that you own to fall

- market risk: the risk of the overall market

- exchange rate risk: the risk associated with changes in the value of currencies

- country risk or political risk: the uncertainty of returns caused by the potential of major changes in the political or economic environment of a country

Video: Unsystematic Investment Risk

- Unsystematic risk:

- diversifiable risk

- 2 types of unsystematic risks:

- business risk: the nature of a business's operation

- financial risk: credit risk or default risk - how a business finances its assets and its operations

- Diversifiable risk: the impact of these risks be reduced through diversification

Practice Assignment: Investment Risk Types

- What is risk tolerance?

- An investor’s level of comfort taking risk

- How much risk an investor can take on a particular investment based on his or her goal and time horizon

- An investor’s level of success

- None of the above

- Which of the following describes the loss of purchasing power through inflation?

- Market risk

- Interest rate risk

- Reinvestment rate risk

- Purchasing power risk

- What are the two types of unsystematic risk?

- Financial risk and business risk

- Business risk and institutional risk

- Educational risk and financial risk

- None of the above

02.02 Analyzing Investment Risk

Video: Measuring Investment Risk

- The main measures of investment risk:

- Beta: the volatility of investment relative to a benchmark

- The benchmark would often be the whole market or market index.

- Beta = 1: the investment is as volatile as the benchmark itself

- Beta < 1: the investment is less volatile than the benchmark

- Beta > 1: the investment is more volatile than the benchmark

- Standard deviation: the data dispersion relative to the average or mean value of a set of data

- Low standard deviation: more predictable investment performance

- High standard deviation: less predictable or more volatile performance

- Sharpe ratio: the risk adjusted return

- To compare the investment return to an investment that is deemed risk free, e.g., treasury bond

- To assess whether the risk is worth taking for the additional return on a particular investment

Reading: 6 Investment Risk Management Strategies

- Article: 6 Investment Risk Management Strategies

- 3 main factors of risk tolerance:

- Risk capacity: How much the investor can afford to lose without it affecting actual financial security

- Based on age, personal financial goals, and an investor’s timeline for reaching those goals.

- Need: How much these investments will have to earn to get the investor where they want to be

- A careful balancing act between taking too much risk and not taking enough

- Emotions: How the investor will react to bad news (with fear and panic? or clarity and control?), and what effect will those emotions have on investing decisions

- Hard to predict until it happens

- Risk management strategies:

- Reevaluating Portfolio Diversification and Asset Allocation

- Lowering Portfolio Volatility

- Rebalancing

- Buying bonds

- Beta

- Investing Consistently

- Getting an Investment Risk Analysis

- Requiring a Margin of Safety

- Establishing a Maximum Loss Plan

Video: Measuring Investment Returns

- Rate of return on investment: the money that's earned or could be lost on an investment

- Typically expressed as a percentage of the investment's initial cost

- e.g., If you bought a stock for $100 that grew to $110, you would have a 10% rate of return.

- Rate of return formular:

\[Return\ Rate=\frac{(Current\ Value - Initial\ Value)}{Initial\ Value} \times 100\]

Reading: What is Considered a Good Return on Investment?

- Article: What Is Considered a Good Return on Investment?

- A good return on investment is generally considered to be around 7% per year, based on the average historic return of the S&P 500 index, adjusted for inflation.

- Cash slowly loses value over time due to inflation if you don't invest.

- Putting money in a savings account that earns interest at a rate that is lower than the inflation rate guarantees that money will lose value over time.

- Different investments, such as CDs, bonds, stocks, and real estate, offer varying rates of return and levels of risk.

- It’s important to consider factors like diversification and time when investing long-term.

- Investing in stocks carries higher potential returns but also higher risk, while investments like CDs offer lower returns but are considered safer.

Practice Assignment: Assessing Investment Risk

- What is measured by beta?

- How much the return on investment is deviating from the expected or average return

- Performance, but it’s used to compare the return of an investment to that of an investment that’s deemed risk-free, like a treasury bond

- The volatility of an investment relative to a benchmark

- Data dispersion relative to the average or mean value of a set of data

- What are the three main factors of an investor’s risk tolerance?

- Risk capacity, need, and emotions

- Risk capacity, need, and wants

- Risk capacity, emotions, and logic

- None of the above

- Which of the following is the correct calculation for rate of return?

- Rate of return = [(Initial value − Current value) ÷ Initial Value ] × 100

- Rate of return = [(Current value − Initial value) ÷ Initial Value ] × 100

- Rate of return = [Current value ÷ Initial Value ] × 100

- None of the above

- According to the Federal Deposit Insurance Corporation (FDIC), what is the national average annual percentage yield for one month of non-jumbo deposits (as of Jan 4, 2021)?

- 0.04%

- 0.05%

- 0.07%

- 0.16%

02.03 Balancing Risk and Return

Video: Investment Risk & Return

- The higher risk, the higher return

- The lower risk, the lower return

- Risk reward ratio: calculating the potential outcomes of any investment transaction - good or bad

- e.g., For a risk reward ratio of 1:3, you risk $1 to hopefully gain $3 in profits

- You divide net profits (reward), by the cost of the investment's maximum risk.

Reading: Suitability: Definition, How It's Measured, and How It's Used for Investing

- Article: Investment Risk: What Every New Investor Should Know

- Higher risk, higher potential return

- Risk balancing:

- Several types of risk:

- market

- business specific

- price volatility

- interest rate

- concentration

Video: Investment Risk Tolerance & How to Find Yours

- Risk tolerance: the amount of risk an investor is willing to take

- Risk capacity: the ability to handle risk financially

- how much can you afford to lose without affecting your security

- Risk appetite: emotional attitude about risk

Reading: Explaining the Different Types of Asset Classes

- Article: Explaining the Different Types of Asset Classes

- Different asset classes:

- Stocks (equities): a single ownership share in a publicly-traded company (a company that trades on a stock exchange)

- You can receive dividends from stocks if a company pays out part of its profits, or you might get capital gains when you sell if the price of the stock has risen.

- Bonds (fixed income): loans you make to a company or government for a predetermined amount of time at a certain amount of interest

- e.g., treasury bonds, corporate bonds, municipal bonds

- Money market accounts or cash equivalents: savings account, or certificate of deposit (CD)

- You get paid interest on the money for lending money to the financial institution.

- Real estate: buying real estate for the purposes of renting the property to generate income or to earn profits as the value of the property appreciates

- Commodities: putting money into metals, energy products, livestock, agricultural products, and so forth

- Commonly through a futures contract

- Future contract: an agreement to buy or sell a certain commodity at a specific quantity at a predetermined price at a later time

- Cryptocurrencies: investing in digital currency that is largely unregulated

- Typically dependant on a direct financial exchange between users, with no involvement from a bank or other third party

- Real estate investment trusts (REITs): investing primarily in real estate or real estate loans, traded like stocks

Practice Assignment: Risk & Return

- What is the risk-reward ratio formula?

- The cost of the investment’s maximum risk divided by net profits (which represent the reward)

- Net profits (which represent the reward) divided by the cost of the investment’s maximum risk

- Net expenses divided by the cost of the investment’s maximum risk

- None of the above

- Which of the following is NOT one of the broad categories of investment risk tolerance?

- Simple risk tolerance

- Aggressive risk tolerance

- Moderate risk tolerance

- Conservative risk tolerance

- How many different stock sectors are there?

- 5

- 7

- 11

- 15

02.04 Module Quiz

Graded Assignment: Balancing Risk and Return

- What is risk tolerance?

- An investor’s level of comfort taking risk

- How much risk an investor can take on a particular investment based on his or her goal and time horizon

- An investor’s level of success

- None of the above

- Which of the following describes the loss of purchasing power through inflation?

- Market risk

- Interest rate risk

- Reinvestment rate risk

- Purchasing power risk

- What are the two types of unsystematic risk?

- Financial risk and business risk

- Business risk and institutional risk

- Educational risk and financial risk

- None of the above

- What is measured by beta?

- How much the return on investment is deviating from the expected or average return

- Performance, but it’s used to compare the return of an investment to that of an investment that’s deemed risk-free, like a treasury bond

- The volatility of an investment relative to a benchmark

- Data dispersion relative to the average or mean value of a set of data

- Which of the following is the correct calculation for rate of return?

- Rate of return = [(Initial value − Current value) ÷ Initial Value ] × 100

- Rate of return = [(Current value − Initial value) ÷ Initial Value ] × 100

- Rate of return = [Current value ÷ Initial Value ] × 100

- None of the above

- What is the risk-reward ratio formula?

- The cost of the investment’s maximum risk divided by net profits (which represent the reward)

- Net profits (which represent the reward) divided by the cost of the investment’s maximum risk

- Net expenses divided by the cost of the investment’s maximum risk

- None of the above

- Which of the following is NOT one of the broad categories of investment risk tolerance?

- Simple risk tolerance

- Aggressive risk tolerance

- Moderate risk tolerance

- Conservative risk tolerance

- How many different stock sectors are there?

- 5

- 7

- 11

- 15

- Which of the following is NOT a factor of an investor’s risk tolerance?

- Market Volatility

- Risk Capacity

- Need

- Emotions

- True or False: Your money loses value if you don’t invest it.

- True

- False